Manhattan Institute - Stephen Miran and Daniel Katz - Proposing to Reform Fed Governance to Enhance Accountability and Executive Control - 提议改革美联储治理以加强问责与行政控制

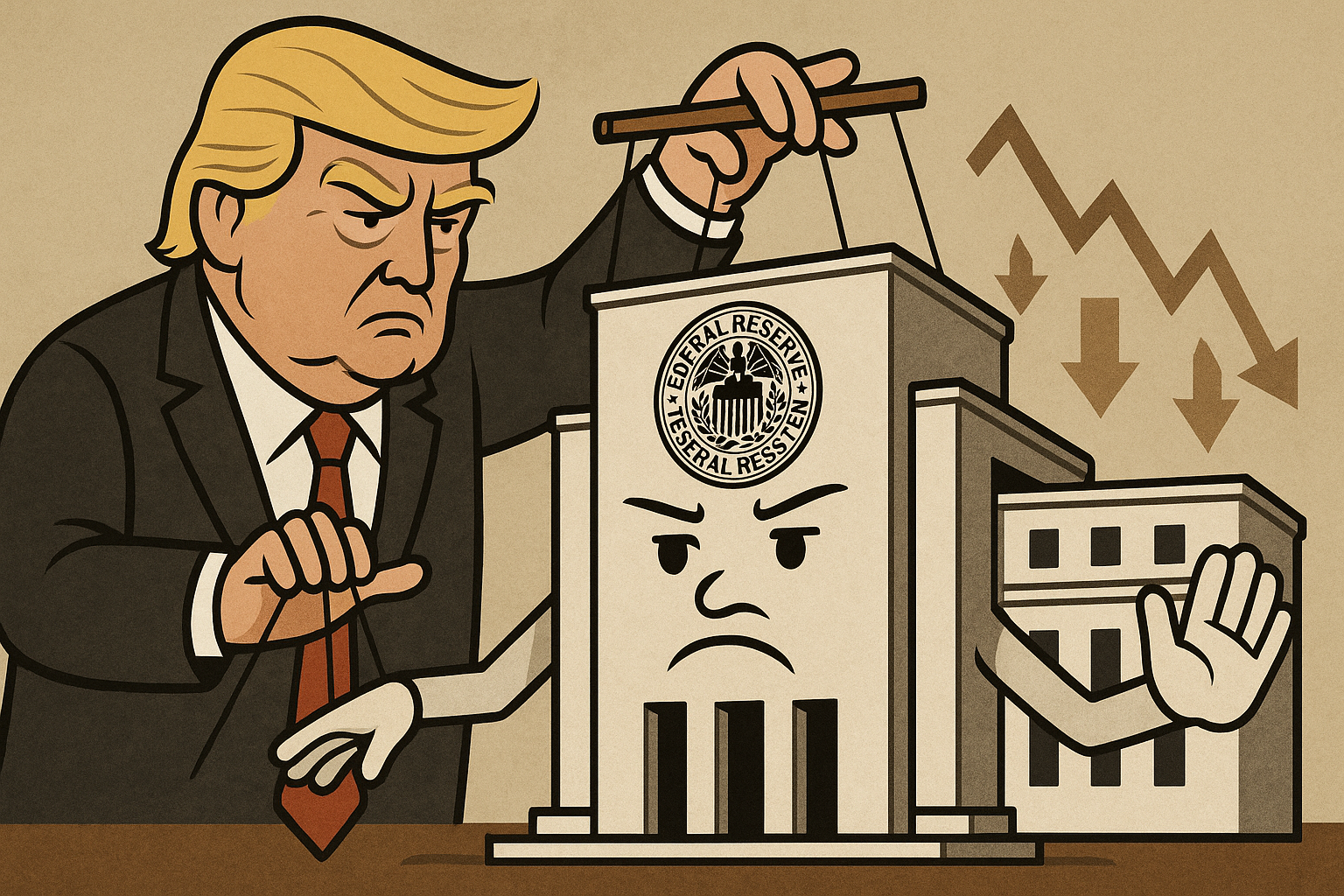

Is it time to radically reform the Federal Reserve's governance, even if it means sacrificing its independence for greater accountability?

EN

Executive Summary

The recent interim appointment of Stephen Miran to the Fed's Board of Governors by Donald Trump is a key political signal, suggesting that the radical reform agenda detailed in Miran's report—aimed at fundamentally reshaping the Fed's governance structure and strengthening executive branch control—may be put on the agenda. The report harshly criticizes the Fed's recent politicization, mandate creep, and lack of accountability, proposing a series of measures to enhance democratic accountability (or government control, in the eyes of critics). This discussion surrounding the Fed's independence is unfolding against a sensitive macroeconomic backdrop, with the U.S. economy facing weakening ISM data and concerns of stagflation triggered by tariff pass-through.

Trump's Appointment of Miran as Interim Governor May Signal Radical Reforms for the Fed

Donald Trump's appointment of Stephen Miran as an interim Fed Governor last week is being interpreted by the market as a signal that Trump is moving further and faster down the path of "hollowing out" the Fed.

- Stephen Miran is the co-author of a report from last year on reforming the Fed's current framework [...].

- Some critics point out that the report "pays lip service to increasing the Fed's independence while its content is all about increasing government control over the Fed," believing its proposals are designed to weaken the Fed's independence.

Existing Problems at the Fed Identified by the Report: Lack of Accountability, Mandate Creep, and Institutional Design Flaws

In a report published by the Manhattan Institute, Stephen Miran and Daniel Katz systematically identified several core issues contributing to the Fed's declining effectiveness, arguing that it has transformed from a technocratic institution into a political one.

- Politicization of Responsibilities and Mandate Creep

- Engaging in credit allocation through tools like Section 13(3) facilities and LSAPs (quantitative easing) is essentially a political decision of "picking winners and losers."

- For example, after the 2008-09 financial crisis, LSAPs distorted the allocation of credit in the economy.

- The Fed continued to purchase MBS in 2022, even though unemployment was near a 70-year low and housing prices had risen by 20% year-over-year, indicating the housing sector did not need additional support.

- LSAPs have pushed its functions into fiscal territory, creating conflicts with the Treasury's debt management, especially during the Covid-19 pandemic, which resembled monetary financing of the deficit.

- Judgments on risk weights in Bank Regulation and decisions on bank mergers also involve political considerations.

- Engaging in credit allocation through tools like Section 13(3) facilities and LSAPs (quantitative easing) is essentially a political decision of "picking winners and losers."

- Active Intervention in Highly Politicized Debates

- Repeated public calls for Congress to enact more fiscal stimulus, as made by Ben Bernanke, Janet Yellen, and Jerome Powell, are considered improper political intervention.

- Introducing issues like Climate Change into the bank regulatory framework has diverted attention from traditional bank regulatory responsibilities.

- For instance, before the collapse of SVB, the Fed failed to adequately focus on the bank's interest-rate risk, instead dedicating resources to climate issues.

- Intervening in issues of Race, such as promoting the race and gender composition of boards and researching structural racism, has damaged its political neutrality.

- "Groupthink" and Personnel Issues

- An internal mentality that "central banks are the only hope" led to the adoption of high-risk strategies like FAIT (Flexible Average Inflation Targeting).

- Former Richmond Fed President Jeffrey Lacker pointed out that "groupthink" was a significant cause of recent policy failures.

- Top personnel frequently move between party politics and technocracy (e.g., Austan Goolsbee and Lael Brainard), and there is a lack of performance-based accountability.

- Even after the most severe monetary policy failure in 40 years, no Fed leader resigned or was fired.

- An internal mentality that "central banks are the only hope" led to the adoption of high-risk strategies like FAIT (Flexible Average Inflation Targeting).

- Inherent Flaws in Institutional Design

- The Reserve Banks are owned by local banking consortia, giving excessive influence to institutional investors (who hold 80% of market capitalization) and the wealthy (who own 89% of stocks), and potentially introducing concepts like ESG.

- 41% of Reserve Banks directors come from the financial sector, creating Conflicts of Interest related to "regulatory capture."

- The San Francisco Fed once avoided removing the CEO of SVB for fear of market signals, leading to SVB's collapse months later.

- The dual private-public ownership structure allows it to circumvent the FOIA (Freedom of Information Act), resulting in a lack of accountability to voters.

The Report's Proposed Comprehensive Reform Framework: Reshaping Governance to Strengthen Accountability

To address the aforementioned issues, the report proposes a comprehensive reform framework [...] aimed at balancing independence with democratic legitimacy.

- Personnel Reforms and Nationalization of the Reserve Banks

- Shorten the terms of Board of Governors members and Reserve Bank leaders to a single 8-year term.

- Allow the U.S. president at-will removal of these officials to strengthen accountability.

- Prohibit Board members from serving in the executive branch within 4 years of leaving office to close the "revolving door."

- Formally nationalize the Reserve Banks, with their boards of directors appointed by state governors to introduce a regional perspective that balances Washington.

- FOMC Voting Rights and Congressional Oversight

- Expand FOMC voting rights to allow all Reserve Bank presidents to vote permanently, changing the voting structure from a 7-5 bias toward the board to a 12-7 bias toward the Reserve Banks to promote diversity of views.

- Since Jerome Powell became chairman, there have been only 13 dissents from Reserve Bank leaders in 50 FOMC meetings, one of the least contentious periods.

- Bring the Fed's approximately $6 billion annual operating budget into the congressional appropriations process (on a 5-year cycle) and enhance scrutiny from the Government Accountability Office.

- Expand FOMC voting rights to allow all Reserve Bank presidents to vote permanently, changing the voting structure from a 7-5 bias toward the board to a 12-7 bias toward the Reserve Banks to promote diversity of views.

- Establishing Chinese Walls to Separate Functions

- Separate bank regulation from monetary policy, with the vice chair for supervision reporting directly to the president.

- Transfer crisis-fighting responsibilities (like 13(3) programs) to a new vice chair for crisis response, whose authority would require a presidential declaration of emergency and last for only 3 months at a time, with renewals requiring Congress's approval.

CN

Key Logic

近期特朗普对Stephen Miran的临时理事任命是一个关键的政治信号,预示着其报告中所详述的、旨在从根本上重塑Fed治理结构并加强行政部门控制的激进改革方案可能被提上议程。这份报告严厉批判Fed近年来的政治化、职责蔓延和问责缺失,并提出了一系列旨在加强民主问责(在批评者看来是政府控制)的措施。而这一系列关于Fed独立性的讨论,正发生在美国经济面临ISM数据走弱、关税传导引发滞胀担忧的敏感宏观背景之下。

特朗普任命Miran为临时理事,或预示美联储将迎激进改革

特朗普上周任命Stephen Miran为Fed临时理事,这一举动被市场解读为特朗普在“架空”Fed的道路上走得更远更快的信号。

- Stephen Miran是去年一篇关于改革Fed现行框架报告的合著者。

- 部分批评指出,该报告“口口声声说是为了增加美联储的独立性,内容全是增加政府对联储控制的内容”,认为其提议旨在削弱Fed的独立性。

报告指出的美联储现存问题:问责缺失、职责扩张与机构设计缺陷

Stephen Miran与Daniel Katz在Manhattan Institute发布的报告中系统性地指出了Fed有效性下降的几大核心问题,认为其已从技术性机构转变为政治性机构。

- 职责范围的政治化与Mandate Creep

- 通过Section 13(3) facilities和LSAPs(量化宽松)等工具进行信贷分配,本质上是“挑选赢家和输家”的政治决策。

- 例如,在2008-09年financial crisis后,通过LSAPs扭曲了经济中的信贷分配。

- Fed在2022年继续购买MBS,尽管当时unemployment接近70年低点,housing prices已同比上涨20%,显示housing sector并不需要额外支持。

- LSAPs使其职能跨入fiscal territory,与Treasury的debt management产生冲突,尤其在Covid-19期间类似monetary financing of the deficit。

- Bank Regulation中对risk weights的判断、bank mergers的决策也涉及政治考量。

- 通过Section 13(3) facilities和LSAPs(量化宽松)等工具进行信贷分配,本质上是“挑选赢家和输家”的政治决策。

- 主动介入高度政治化的辩论

- 多次公开呼吁Congress采取更多fiscal stimulus,例如Ben Bernanke、Janet Yellen以及Jerome Powell都曾如此,被认为是不当的政治干预。

- 将Climate Change等议题引入bank regulatory framework,分散了对传统bank regulatory responsibilities的关注。

- 例如,在SVB倒闭前,未能充分关注银行的interest-rate risk,反而将资源投入climate issues。

- 介入Race问题,如宣传董事的race和gender构成,研究structural racism,损害了其政治中立性。

- “Groupthink”与人事问题

- 内部“central banks是唯一的希望”的心态导致采纳了FAIT等高风险策略。

- 前Richmond Fed主席Jeffrey Lacker指出,“groupthink”是近年政策失误的重要原因。

- 高层人员在party politics和technocracy间频繁流动(如Austan Goolsbee和Lael Brainard),且缺乏基于绩效的问责制。

- 即使在发生40年来最严重的货币政策失误后,也没有Fed领导人因此辞职或被解雇。

- 内部“central banks是唯一的希望”的心态导致采纳了FAIT等高风险策略。

- 机构设计的固有缺陷

- Reserve Banks由local banking consortia拥有,导致institutional investors(占市值80%)和富人(拥有89%的股票)影响力过大,且可能引入ESG等理念。

- Reserve Banks董事中有41%来自financial sector,存在“监管俘获”的Conflicts of Interest。

- San Francisco Fed曾因担心市场信号而避免罢免SVB的CEO,导致数月后SVB崩溃。

- dual private-public ownership structure使其能规避FOIA的约束,缺乏对voters的问责。

报告提出的全面改革框架:重塑治理以加强问责

为解决上述问题,报告提出了一套旨在平衡独立性与民主合法性的全面改革框架。

- Personnel Reforms与Nationalization of the Reserve Banks

- 将Board of Governors成员和Reserve Bank领导人任期缩短为8年单一任期。

- 允许U.S. president随意罢免(at-will removal)这些官员,以加强问责。

- 禁止Board members离职后4年内在executive branch任职,关闭“旋转门”。

- 将Reserve Banks正式国有化,其boards of directors由各州governors任命,以引入区域视角制衡Washington。

- FOMC Voting Rights与Congressional Oversight

- 扩大FOMC投票权,允许所有Reserve Bank行长永久投票,将投票结构从偏向board的7-5变为偏向Reserve Banks的12-7,以促进观点多样性。

- 自Jerome Powell担任主席以来,在50次FOMC会议中,仅有13次Reserve Bank领导人提出异议,是异议最少的时期之一。

- 将Fed约$60亿的年度运营预算纳入congressional appropriations process(以5年为周期),并加强Government Accountability Office的审查。

- 扩大FOMC投票权,允许所有Reserve Bank行长永久投票,将投票结构从偏向board的7-5变为偏向Reserve Banks的12-7,以促进观点多样性。

- 建立Chinese Walls分离各项职能

- 将bank regulation与货币政策分离,由vice chair for supervision直接向总统报告。

- 将crisis-fighting responsibilities(如13(3) programs)转移给新的vice chair for crisis response,其授权需总统宣布紧急状态,且每次仅持续3个月,续期需Congress批准。