MIT - The GenAI Divide - Explaining the ROI Gap in Enterprise AI and Strategies for Bridging It Through Adaptive Systems and Organizational Redesign - GenAI鸿沟:企业AI投资回报率差距探因及通过适应性系统与组织重塑实现跨越的策略

Despite massive investments, why are most enterprises failing to realize GenAI's promised ROI, and how can they bridge this critical 'GenAI Divide'?

MIT - The GenAI Divide STATE OF AI IN BUSINESS 2025 - 20205818

Despite massive corporate investments in Generative AI (GenAI), the vast majority of projects fail to yield tangible Return on Investment (ROI), creating a significant "GenAI Divide." According to a recent report from the Massachusetts Institute of Technology (MIT), enterprises have invested a staggering $30 billion to $40 billion in GenAI, yet a shocking 95% of organizations have failed to see any returns from these investments. This stark contrast between high adoption rates and low transformation highlights a deep-seated contradiction in current enterprise AI strategies.

The report identifies the fundamental cause of this divide as the pervasive lack of learning capabilities in current GenAI systems—meaning they cannot retain feedback, adapt to context, or improve over time. Furthermore, misguided enterprise GenAI procurement and organizational implementation strategies have exacerbated the problem. Therefore, the key to bridging this divide lies in enterprises shifting towards procuring AI solutions that possess deep customization and learning capabilities, while simultaneously redesigning internal organizational structures to drive AI adoption from the front lines, and viewing AI vendors as business service partners rather than mere Software as a Service (SaaS) providers, thereby achieving true business transformation and value creation.

Manifestations of the "GenAI Divide": High Adoption, Low Transformation

The "GenAI Divide" is not only evident in the overall low ROI for enterprises but also manifests in significant disparities in industry transformation and tool deployment.

The Reality of Industry Disruption: Structural Changes in a Few Sectors

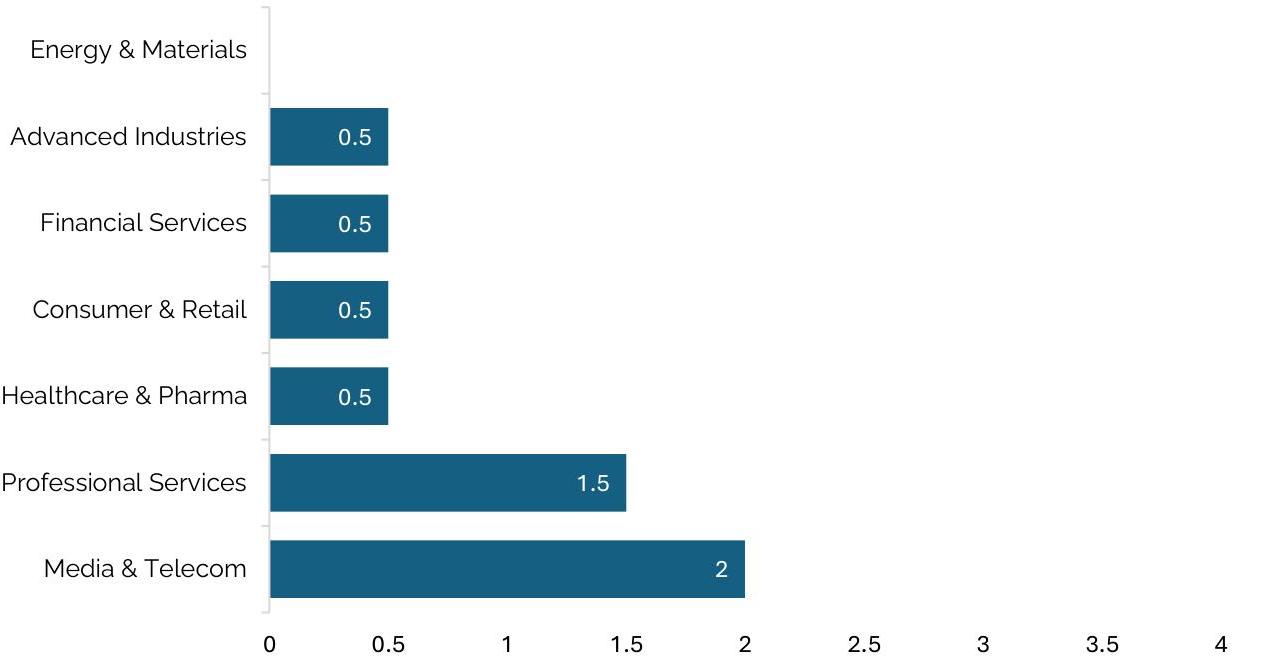

While GenAI has garnered significant attention, its disruptive structural effects show a clear polarization across different industries. The report quantifies the state of disruption through the AI Market Disruption Index, which scores disruption status from 0 to 5 based on 5 observable metrics: market share volatility, revenue growth of AI-native companies, emergence of new AI-driven business models, changes in user behavior, and the frequency of organizational changes driven by AI tools.

AI Market Disruption Index by Industry

Data indicates that only two major industries, Technology and Media & Telecom, show meaningful structural changes. For example, the Technology sector has seen new challengers emerge (e.g., Cursor vs. Copilot) and workflow shifts; the Media & Telecom industry has witnessed the rise of AI-native content and evolving advertising dynamics. However, 7 other industries, including Professional Services, Healthcare & Pharma, Consumer & Retail, Financial Services, Advanced Industries, and Energy & Materials, despite active GenAI pilot initiatives, have experienced almost no true structural change. This directly reflects the "GenAI Divide": widespread experimentation has not led to substantial transformation. For instance, while the Professional Services sector has seen efficiency gains, its client delivery model remains largely unchanged; the Healthcare & Pharma industry primarily remains in documentation and transcription pilots, with no changes to clinical models; Financial Services focuses on back-end automation, with stable client relationships.

The Pilot-to-Production Gap: Low Deployment Rates for Enterprise AI Tools

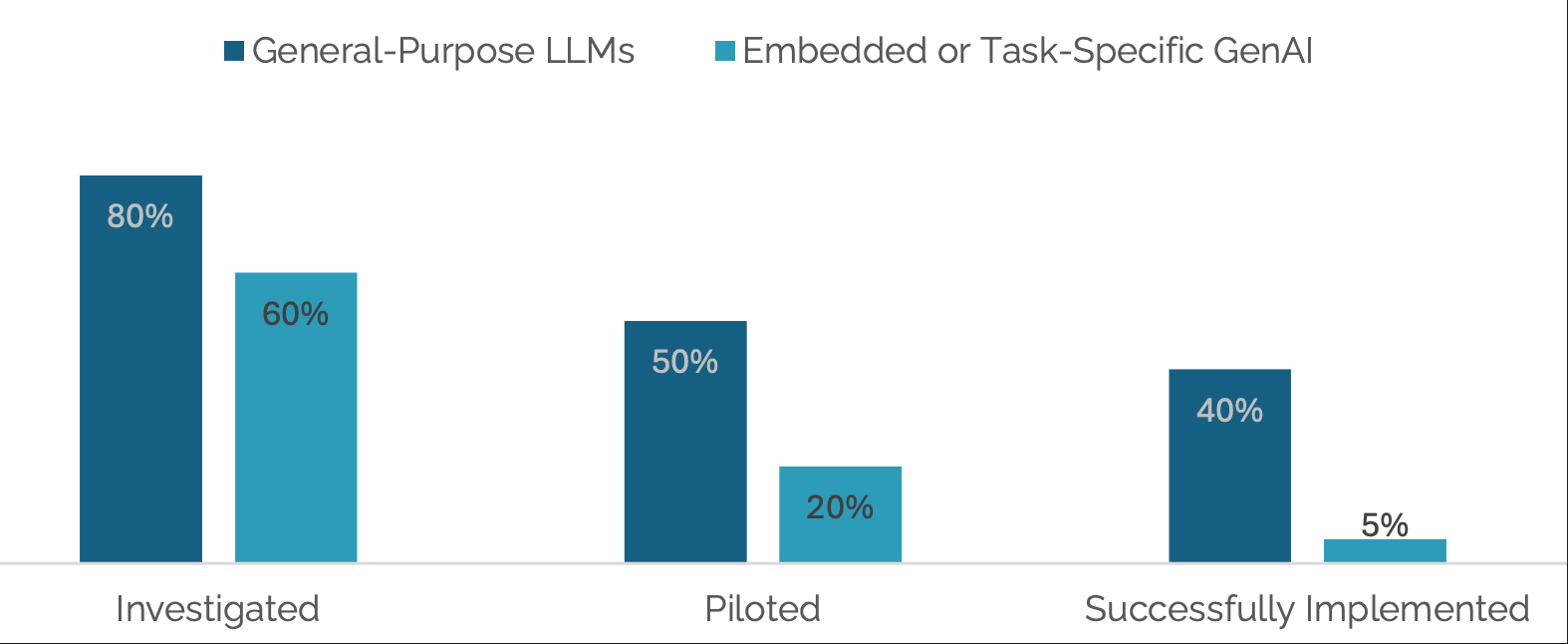

There is a massive discrepancy between the investigation of GenAI tools and their actual deployment. The report notes that only 5% of custom enterprise AI tools successfully reach production environments.

Steep Drop from Pilot to Production Reveals GenAI Divide

While Large Language Model (LLM) chatbots like ChatGPT and Copilot have higher pilot-to-implementation rates (83%) and are widely adopted (over 80% of organizations explore or pilot, nearly 40% report deployment), these tools primarily boost individual productivity rather than generating measurable impact on enterprise income statements. In contrast, enterprise-grade systems (whether custom-developed or vendor-sold) are facing "quiet rejection": 60% of organizations have evaluated such tools, but only 20% reach the pilot phase, and ultimately, only 5% are successfully deployed. The primary reasons for this steep drop include fragile workflows, a lack of contextual learning capabilities, and insufficient alignment with daily operations.

Notably, large enterprises with annual revenues exceeding $100 million lead in the number of AI pilots and employee engagement, but their pilot-to-scale conversion rate is the lowest. Conversely, mid-market companies act more swiftly and decisively, with an average time from pilot to full implementation of only 90 days, compared to 9 months or more for large enterprises.

Why the "Divide"? — The Learning Capability Gap is Core

The emergence of the "GenAI Divide" is not accidental; it stems from deep-seated learning capability gaps, misaligned investment patterns, and organizational design challenges.

The Shadow AI Economy: Insights from Employee-Driven Initiatives

While official enterprise AI initiatives may stagnate, employees are already bridging the "GenAI Divide" through personal AI tools. This "Shadow AI" phenomenon, where employees use personal ChatGPT accounts, Claude subscriptions, and other consumer tools to automate much of their work—often without Information Technology (IT) department knowledge or approval—frequently yields better ROI than formal initiatives.

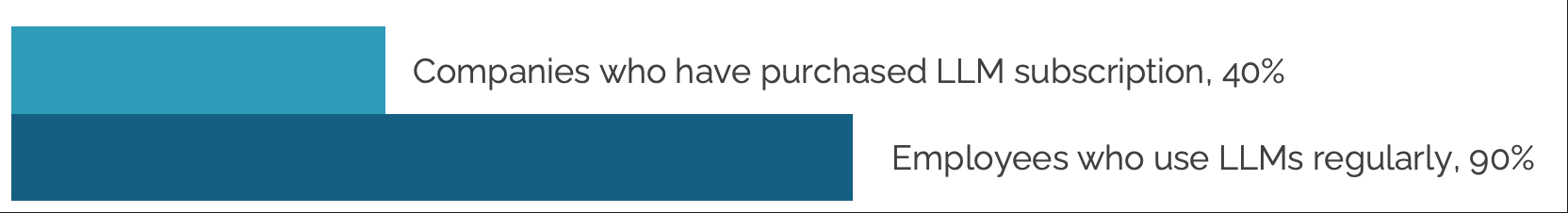

Shadow AI Economy: Employee Usage Far Exceeds Official Adoption

The report finds that while only 40% of companies report purchasing official LLM subscriptions, over 90% of employees surveyed report regularly using personal AI tools for work tasks. Many "Shadow AI" users leverage LLMs multiple times a week for work, while their company's official AI initiatives remain in the pilot phase. This indicates that when individuals are given flexible, responsive tools, they can successfully bridge the "GenAI Divide."

Misaligned Investment Patterns: Budget Bias and ROI Divergence

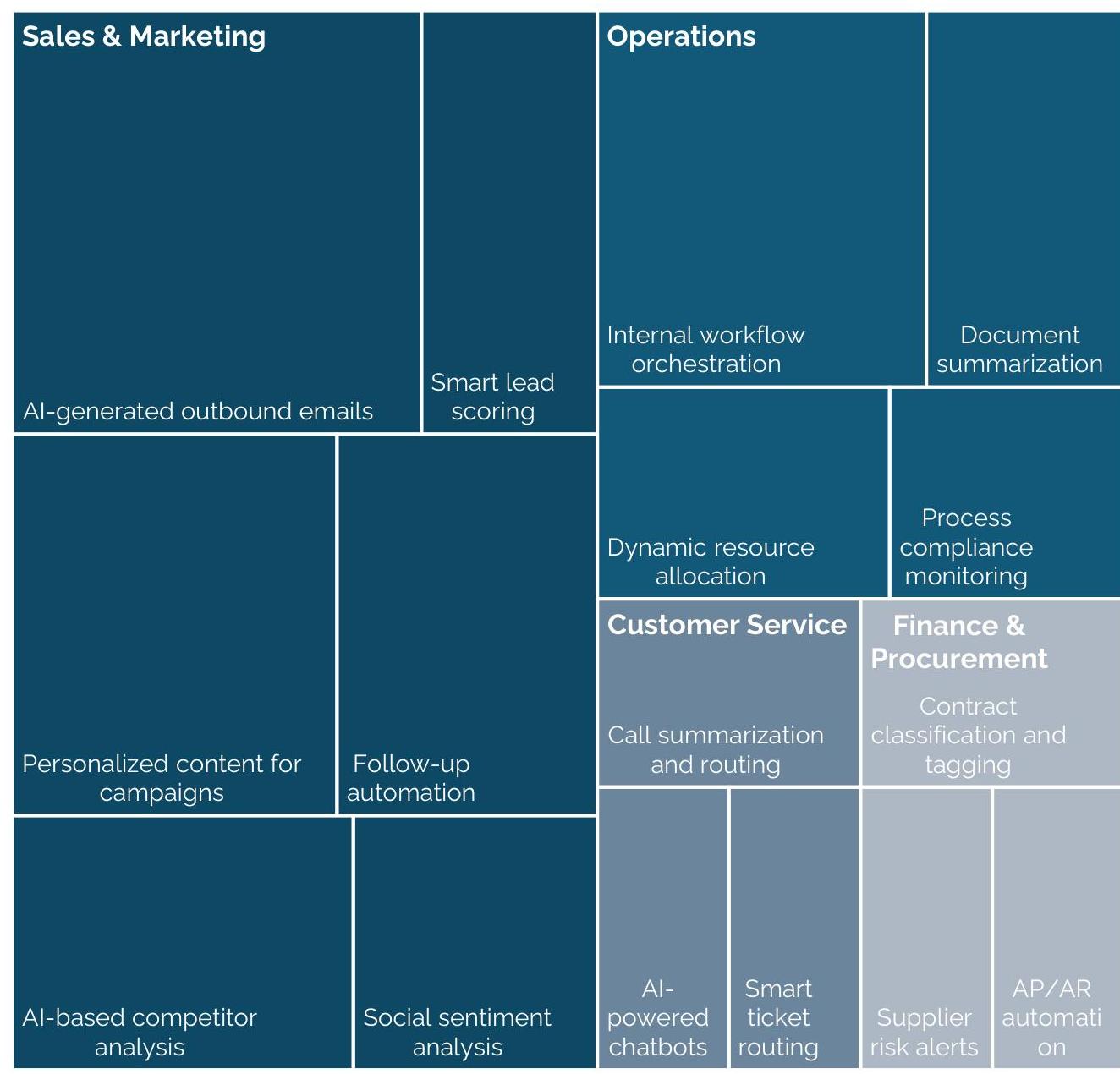

Enterprise investment allocation in GenAI also reveals the "Divide": 50% of GenAI budgets flow to Sales & Marketing departments. However, the report shows that back-office automation typically yields higher ROI.

GenAI Investment by Function

This bias reflects easier metric attribution (e.g., demo volume or email response times directly tied to board-level Key Performance Indicators (KPIs)), rather than actual value creation, leading organizations to focus on the wrong priorities. In contrast, back-office functions such as Legal, Procurement, and Finance, while offering more subtle efficiency gains, find their achievements difficult to highlight in executive meetings or investor updates. This investment bias directs resources towards visible but often less transformative use cases, thus perpetuating the "GenAI Divide," while the truly highest ROI back-office opportunities remain underfunded.

Core Reason for Pilot Stagnation: Lack of Learning Capability

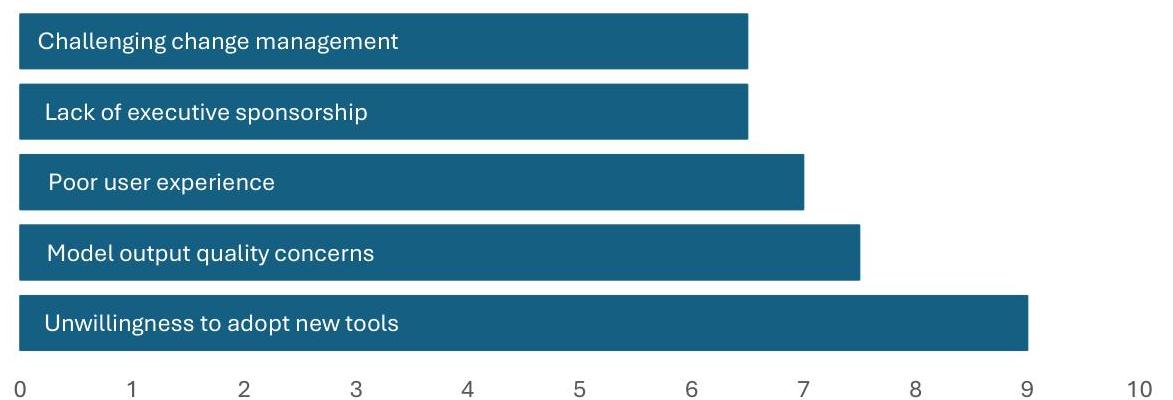

The primary factor causing organizations to remain on the wrong side of the "GenAI Divide" is the learning capability gap of AI tools—i.e., tools lacking learning abilities, poor integration, or misalignment with workflows.

Top Barriers to Pilot Success: Enterprise AI Scaling Challenges

The report surveyed executives and front-line users from 52 organizations to understand why GenAI pilot projects rarely progress beyond the experimental stage. The results show that, besides resistance to new tools, "model quality concerns" is the second largest obstacle. Although tools like ChatGPT are widely adopted by consumers (over 40% of knowledge workers personally use AI tools), the same users find them unreliable when used in enterprise systems. This preference reveals a fundamental contradiction: professionals who use ChatGPT daily for personal work demand that enterprise-grade AI tools possess learning and memory capabilities.

The limitations of ChatGPT precisely highlight the core problem of the "GenAI Divide": it forgets context and lacks the ability to learn and evolve. For high-risk or complex tasks, user trust in AI significantly declines.

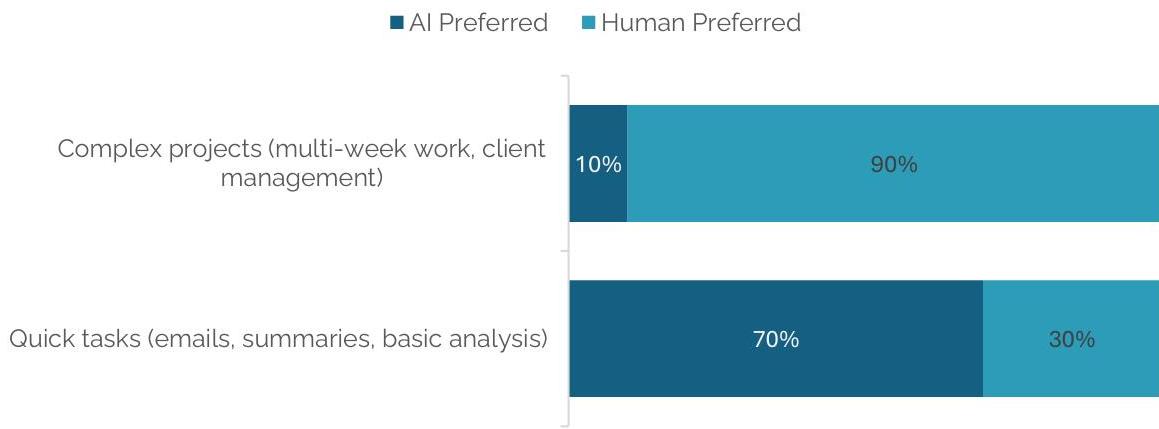

Perceived Applicability for High-Risk Tasks

Data shows that AI has won in simple tasks (e.g., writing emails, basic analysis), with 70% preferring AI for email drafting and 65% for basic analysis. But for complex or long-term work, humans dominate with a 9-to-1 advantage. This demarcation is not about intelligence itself, but about memory, adaptability, and learning capabilities, which are precisely what differentiate tools on either side of the "GenAI Divide." Agentic AI systems, by design embedding persistent memory and iterative learning, directly address the learning capability gap that defines the "GenAI Divide."

Bridging the "GenAI Divide": Best Practices and Future Outlook

Organizations and vendors that successfully bridge the "GenAI Divide" adopt common approaches: they build adaptive, embedded systems that learn from feedback.

Success Strategies of Best Builders: Customization and Referral Networks

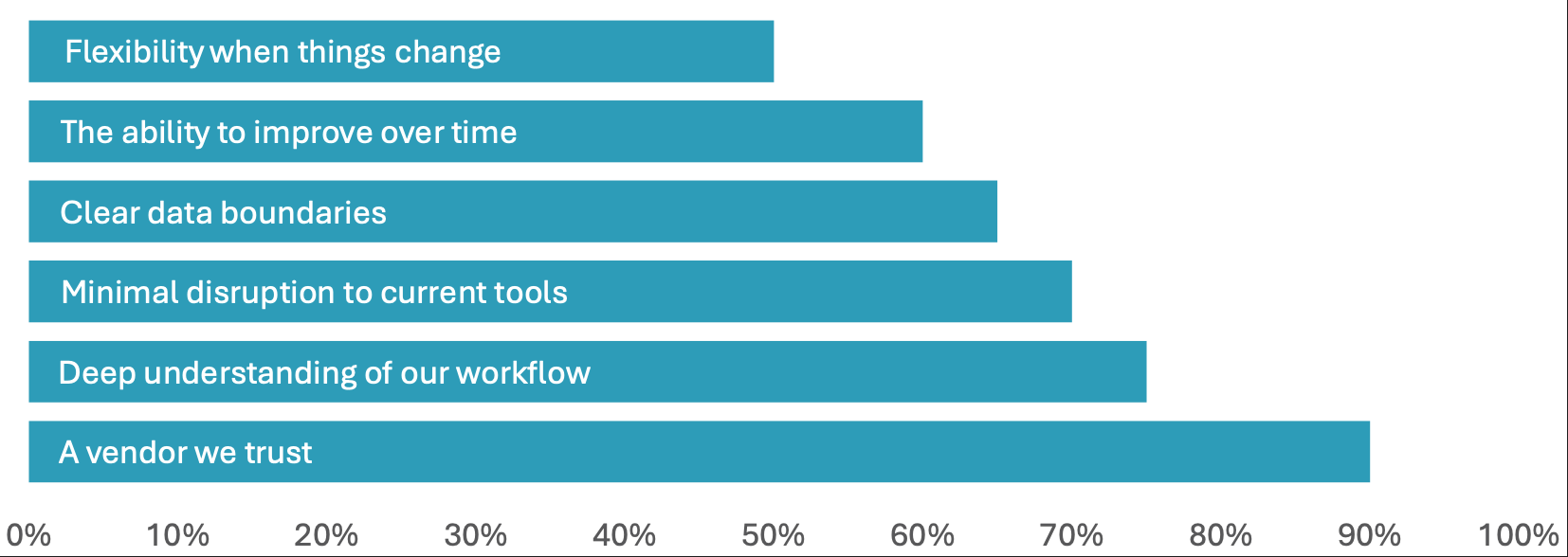

The most successful vendors understand that bridging the "GenAI Divide" requires building AI systems that can learn and improve within their environments. When selecting GenAI vendors, executives prioritize "a vendor we trust," "deep understanding of our workflow," "minimal disruption to current tools," "clear data boundaries," "ability to improve over time," and "flexibility."

Executive Criteria for GenAI Vendor Selection

The most successful startups address the need for learning systems and skepticism towards new tools by executing two strategies:

- Customization for Specific Workflows: They embed AI tools into non-critical or adjacent processes, performing significant customization to demonstrate clear value, then gradually expanding to core workflows. These successful tools often feature low configuration burden and immediate visible value, such as voice AI for call summarization and routing, document automation for contracts and forms, and code generation for repetitive engineering tasks.

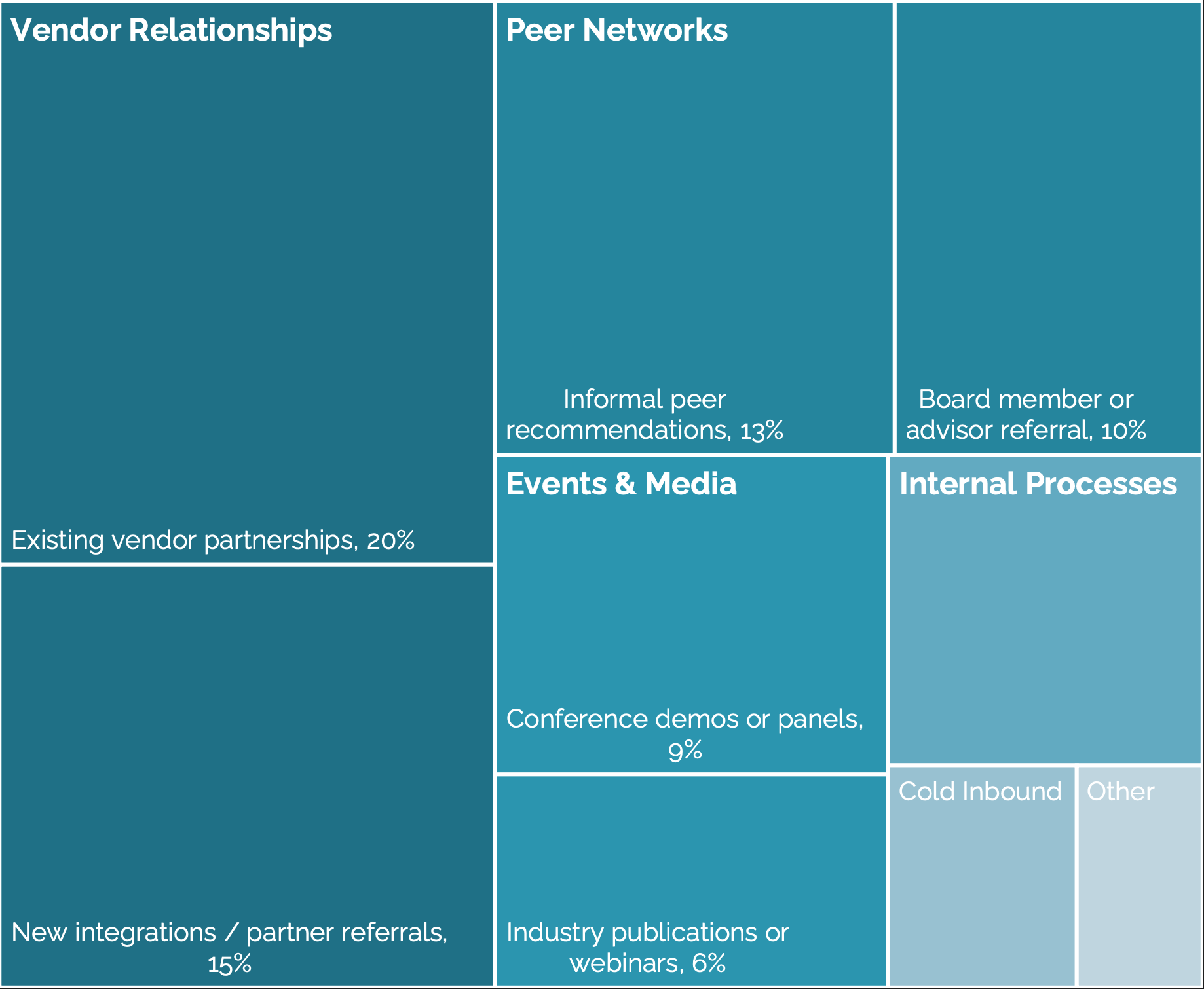

- Leveraging Referral Networks: To overcome trust barriers, successful startups often utilize channel partnerships with system integrators, procurement recommendations from board members or advisors, and distribution through familiar Enterprise Marketplaces to accelerate adoption.

How Leaders Discover GenAI Solutions

The report emphasizes that the window for bridging the "GenAI Divide" is rapidly closing. Enterprises are locking in learning-capable tools, such as Microsoft 365 Copilot and Dynamics 365, which are integrating persistent memory and feedback loops, and OpenAI's ChatGPT memory beta also signals similar expectations for general-purpose tools.

Success Strategies of Best Buyers: Organizational Design and BPO Client Mindset

Organizations successfully bridging the "GenAI Divide" adopt a different AI procurement strategy: they act more like Business Process Outsourcing (BPO) clients than Software as a Service (SaaS) clients. This means they demand deep customization, drive adoption from the front lines, and hold vendors accountable based on business metrics.

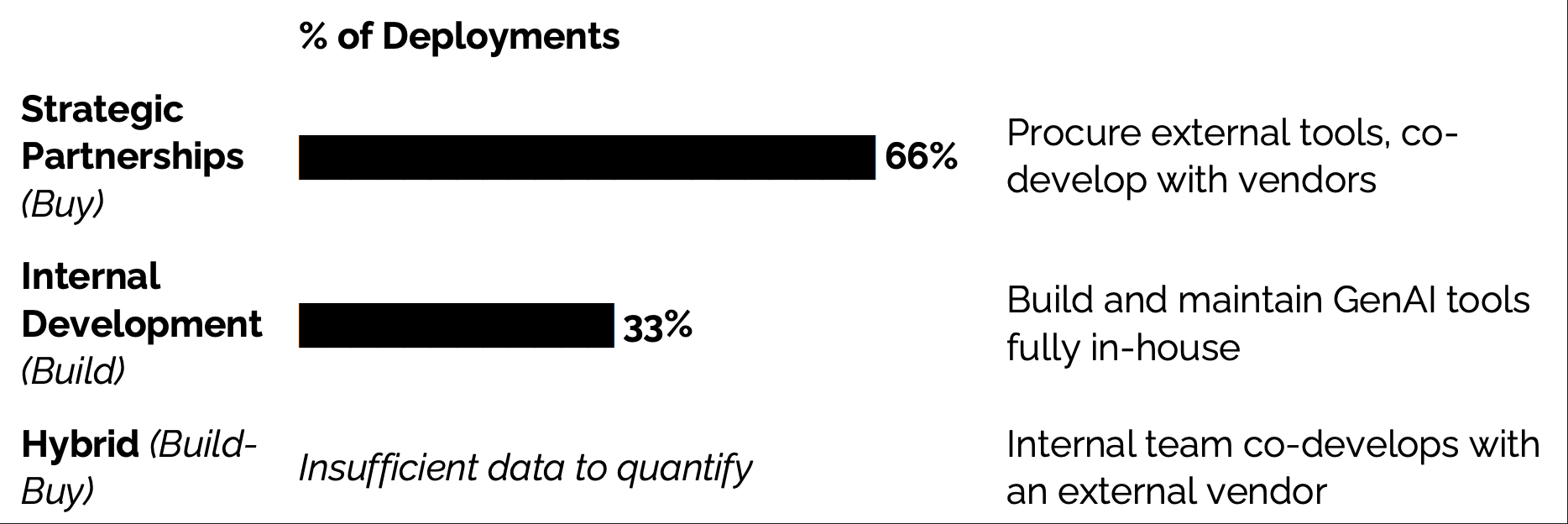

GenAI Implementation Team Structure and Success Rate

Report data shows that companies succeed when they decentralize implementation authority but retain accountability. Specifically, strategic partnerships (i.e., procuring external tools and co-developing with vendors) achieve higher successful deployment rates (approximately 67%), significantly exceeding internal self-building (approximately 33%). Furthermore, employee usage of externally partnered tools is almost 2x that of internally built tools, often leading to faster value realization, lower total costs, and better alignment with operational workflows.

Successful buyers treat AI startups as business service providers and benchmark them against the standards of consulting firms or BPO providers. These organizations demand that AI tools deeply align with internal processes and data, and they measure tools based on operational outcomes rather than model benchmarks. They maintain collaboration through early failures, viewing deployment as co-evolution, and source AI initiatives from front-line managers rather than central labs. This bottom-up procurement, combined with executive accountability, accelerates adoption while maintaining operational alignment.

Where True ROI Lies: Value Creation Beyond the Divide

Organizations that bridge the "GenAI Divide" find that ROI is often highest in overlooked functions like Operations and Finance. True gains come from replacing Business Process Outsourcing (BPO) and external agencies, rather than cutting internal staff.

Although 50% of AI budgets flow to Sales & Marketing, some of the most significant cost savings documented in the report come from back-office automation. For example, front-office gains include 40% faster lead qualification and a 10% increase in customer retention through AI-driven follow-ups. Back-office gains are even more significant, such as BPO elimination saving $2 million to $10 million annually in customer service and document processing, a 30% reduction in external creative and content costs, and $1 million in annual savings on outsourced risk management fees in Financial Services risk checks. These gains were achieved without mass layoffs, but rather by reducing external spending, eliminating BPO contracts, cutting agency fees, and replacing expensive consultants with AI-driven internal capabilities.

The Reality of Employment Impact: Workforce Transformation, Not Mass Layoffs

GenAI has begun to impact the workforce, primarily through selectively replacing previously outsourced functions and limiting hiring patterns, rather than through mass layoffs. GenAI-driven workforce reductions are concentrated in functions historically considered non-core business activities, such as customer support operations, administrative processing, and standardized development tasks. In these areas, layoff percentages range from 5% to 20%.

In industries less affected by AI (e.g., Healthcare, Energy, Advanced Industries), most executives report no or anticipated no hiring reductions within the next 5 years. Conversely, in the Technology and Media industries, where GenAI has had a measurable impact, over 80% of executives expect hiring volumes to decrease within the next 24 months.

Furthermore, the adoption of GenAI has led to changes in internal organizational hiring strategies, with executives consistently emphasizing AI literacy as a fundamental capability requirement, prioritizing candidates who demonstrate proficiency with AI tools during recruitment. MIT's Project Iceberg analysis shows that current automation potential accounts for 2.27% of the US labor force value, involving 39 million roles, valued at $2.3 trillion. This potential risk will become actionable as AI systems develop persistent memory, continuous learning, and autonomous tool integration, signaling a gradual workforce transformation.

Beyond Agents: The Future of the Agentic Web

The next evolution of personal AI agents is the Agentic Web, an era where autonomous systems can discover, negotiate, and coordinate across the entire internet infrastructure, fundamentally changing how business processes operate. The foundational infrastructure for this transformation is emerging through protocols like Model Context Protocol (MCP), Agent-to-Agent (A2A), and NANDA.

In the Agentic Web, systems will be able to autonomously discover the best vendors and evaluate solutions without human research; establish dynamic Application Programming Interface (API) integrations in real-time; enable trustless transactions via blockchain; and develop self-optimizing workflows across multiple platforms and organizational boundaries. This represents a fundamental shift from today's human-mediated business processes to autonomous systems operating across the entire internet ecosystem, with impacts far exceeding the current "GenAI Divide."

Conclusion: A Guide to Bridging the "GenAI Divide"

Organizations successfully bridging the "GenAI Divide" generally adhere to three key principles: they choose to buy rather than build AI solutions; they empower front-line managers instead of relying on central labs to drive AI initiatives; and they prioritize tools that can deeply integrate and adapt over time.

The most forward-thinking organizations are already experimenting with Agentic Systems, which can learn, remember, and act autonomously within defined parameters. This shift is not just a tool-level innovation but also the emergence of the Agentic Web: a persistent, interconnected layer of learning systems capable of collaborating across vendors, domains, and interfaces.

As enterprises lock in vendor relationships and feedback loops by 2026, the window for bridging the "GenAI Divide" is rapidly narrowing. The next wave of AI adoption will be won by systems capable of learning and memory, or those deeply customized for specific processes. For organizations currently stuck in the "Divide," the path forward is clear: stop investing in static tools that require continuous prompting, and instead partner with vendors offering customized systems, focusing on workflow integration rather than flashy demos. The "GenAI Divide" is not insurmountable, but crossing it requires fundamentally different choices in technology selection, partnership building, and organizational design.