US Economy and Markets Under Strain - Data Reliability Challenges, Tariff-Induced Inflation, and Divergent Equity Returns with Extreme Quality Valuations - 美国经济与市场承压:数据可靠性挑战、关税引发的通胀及股票回报分化与极端高质量估值

How are challenged data reliability, tariff-induced inflation, and extreme quality stock valuations collectively straining the US Economy and its financial markets?

EN

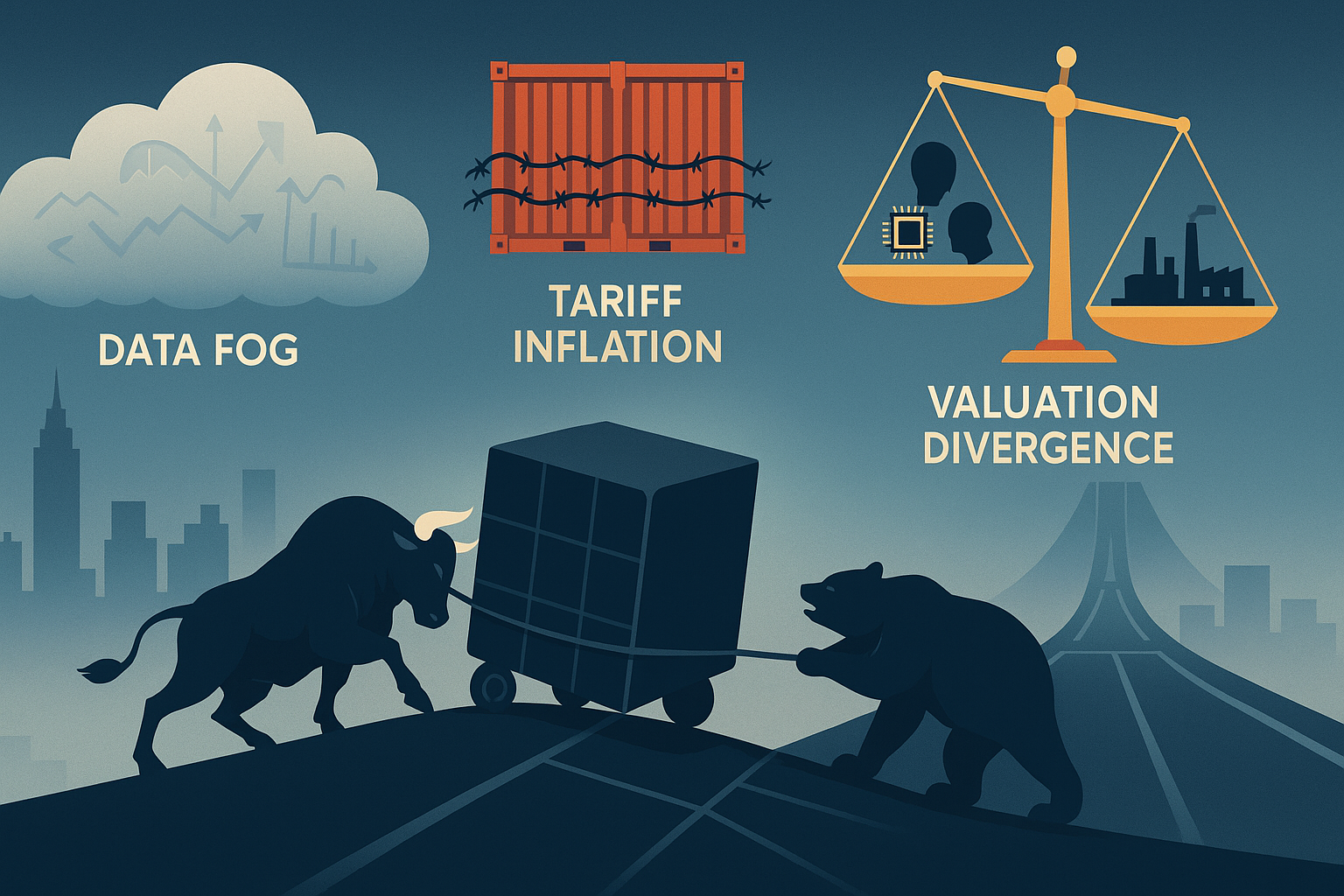

The Triple Pressure on the US Economy and Markets: Data Fog, Tariff Inflation, and Valuation Divergence

The US economy and its financial markets are currently navigating uncertain waters. A trio of intertwined pressures—increasingly obscure macroeconomic data, policy-driven inflation, and extreme divergence within the stock market—collectively form a complex challenge that is testing the wisdom and resolve of both policymakers and investors. These are not three isolated issues, but rather a mutually reinforcing cycle of pressure, profoundly impacting everything from monetary policy to asset pricing.

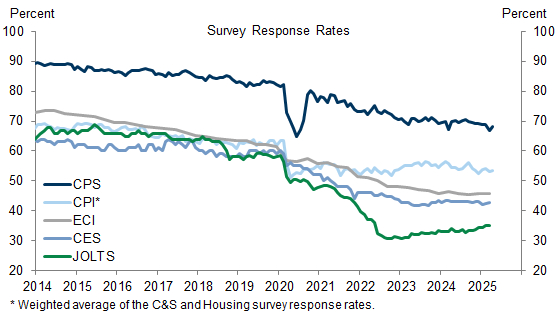

The Decision-Making Dilemma in a Data Fog: When the Economic Compass Fails

The very foundation of all analysis—economic data—is facing unprecedented reliability challenges. In recent years, response rates for nearly all key US government statistical surveys have seen a significant decline, a long-term trend that was sharply accelerated during the pandemic. For example, compared to the 2015-2019 average, the response rate for the nonfarm payrolls survey has dropped by 18 percentage points, while the rate for job openings (JOLTS) has plummeted by 30 percentage points.

Changes in Response Rates for Major US Economic Surveys (2014-2025)

This decline in response rates directly erodes data quality, leading to increased monthly volatility and wider standard errors. This means that behind every economic "point estimate" we see, the "confidence interval" in which the true value lies has become much wider. For instance, the increased standard error for the JOLTS job openings data implies that its 90% confidence interval is nearly 700,000 jobs wide. This presents a huge dilemma for the data-dependent Federal Reserve, which must formulate far-reaching monetary policy amidst an increasingly blurry economic picture.

However, a key paradox emerges: despite declining data quality, financial markets are reacting with unusual intensity to data surprises, especially inflation data. Currently, the US Treasury market's reaction to a standardized inflation surprise is 2.7 times its normal historical level. This heightened sensitivity precisely reflects the high degree of uncertainty about the economic outlook. In an environment of increased "noise," the market is desperately trying to grasp any possible "signal," which in itself exacerbates market volatility.

The Cost of Tariffs: A Direct Source of Inflationary Pressure

Against the backdrop of uncertain macroeconomic data, a clear policy action—tariffs—is injecting direct inflationary pressure into the economy. The pass-through of tariff costs is not a simple linear process but a complex allocation among foreign exporters, US businesses, and end consumers.

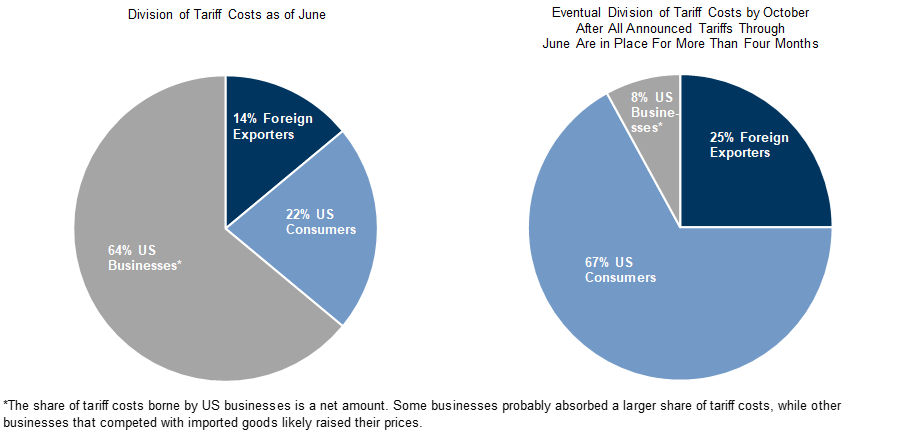

Research indicates that foreign exporters have absorbed a portion of the tariff costs by lowering their export prices to the US. However, a larger share of the cost is ultimately passed on domestically. As of June, 64% of the tariff costs were temporarily absorbed by US businesses, with 22% borne by US consumers. But this landscape is set to change dramatically over time. By October of this year, after the announced tariffs are fully in effect and have been passed through for four months, the share borne by US consumers is projected to soar to 67%. Meanwhile, the net share for US businesses will fall to below 10%, with foreign exporters shouldering the remaining 25%.

Division of Tariff Costs (As of June and Projected for October) (Source: Goldman Sachs)

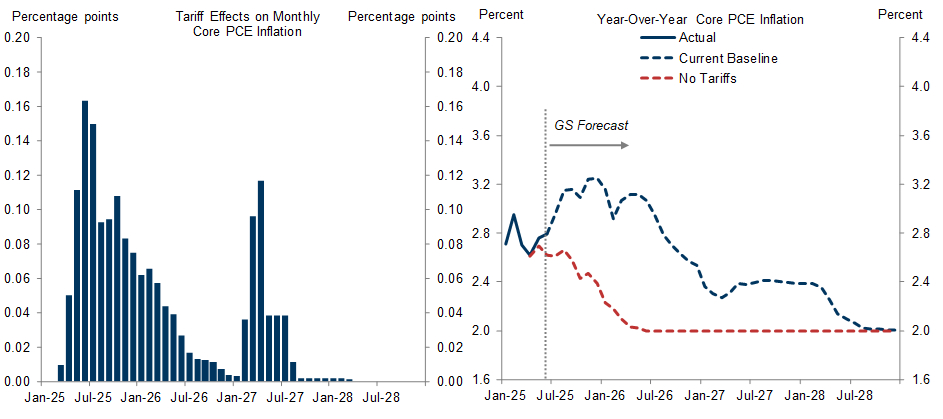

This cost pass-through is already being tangibly reflected in the core PCE (Personal Consumption Expenditures) price index. According to Goldman Sachs estimates, tariff effects have already lifted the core PCE price level by 0.20% and are expected to push it up by an additional 0.5% between August and December. This implies that tariffs alone could push the year-end core PCE inflation rate to 3.2%, a level well above the Federal Reserve's target.

Projected Impact of Tariffs on Annual Core PCE Inflation (Source: Goldman Sachs)

A Fractured Market: The Risks of the Quality Bubble

The complex macroeconomic environment and policy pressures have combined to create a profound divergence within the stock market. Although the S&P 500 index has shown robust performance year-to-date, this masks a bifurcated reality within the market. Returns are highly concentrated in a few specific themes, such as AI-related stocks and certain large-cap names, while the median stock's performance has been far more lackluster.

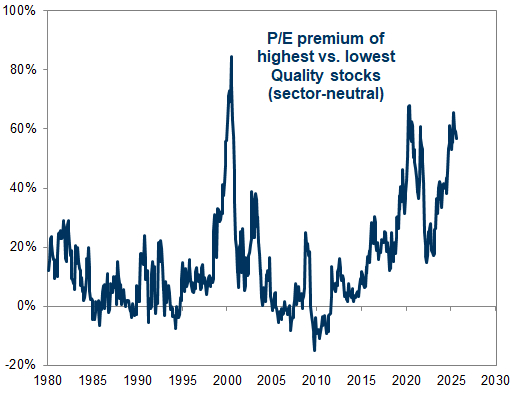

This divergence stems from investors' "flight to safety" behavior amidst uncertainty, flocking to companies perceived as "high quality"—those with strong balance sheets, high profit margins, and stable returns. This concentrated chase has pushed the valuation of high-quality stocks to historical extremes. The P/E valuation premium of high-quality stocks relative to low-quality stocks now stands at a staggering 57%, a level that ranks in the 94th percentile of historical data over the past 30 years, indicating an extremely crowded trade.

P/E Premium of High-Quality Stocks Relative to Historical Levels (Source: Goldman Sachs)

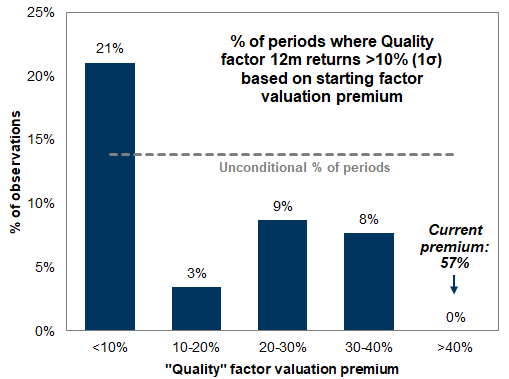

Extreme valuation is, in itself, a risk. Historical data shows that while starting valuation has limited predictive power for short-term returns, it is an effective indicator of the future "asymmetry" of the return distribution. When the quality factor's valuation premium is at an extreme high (like the current level of over 40%), the probability of it significantly outperforming the market in the future is minimal. Data shows that under these conditions, the frequency of the quality factor achieving a return of over 10% in the following 12 months is zero.

Probability of High-Quality Stocks Significantly Outperforming is Low at Extreme Starting Valuations (Source: Goldman Sachs)

This means that the current strategy of chasing high-quality stocks now has a risk/reward profile that is severely skewed to the downside. Should the macroeconomic outlook improve, or if the monetary policy path signals an unexpectedly dovish turn, the low-quality stocks abandoned by the market could experience a sharp rally, while the richly valued "darlings" would face pressure for a correction.

Conclusion: A Mutually Reinforcing Cycle of Pressure

In summary, the US economy and financial markets are trapped in a self-reinforcing pressure cycle. Unreliable economic data makes the Federal Reserve's policymaking exceptionally difficult; simultaneously, tariff policy directly pushes up the inflation that the Fed is striving to control; and this dual uncertainty in macroeconomics and policy drives investors to pile into a few "safe" assets, creating new valuation bubbles and market fragility.

For investors, this implies that simple index-tracking strategies may not reflect the true risks of the market. In the current environment, discerning the signal from the noise in the data, assessing the real impact of policies, and cautiously viewing the extreme valuation divergence within the market will be key to navigating this fog and managing risk.